Good pictures

Good picturesHow much is too much for a caffeine fix?

Prices like £5 in London or $7 in New York for a cup of coffee may be unthinkable to some – but it could soon become a reality thanks to a “perfect storm” of economic and environmental factors in the world’s top coffee-producing regions.

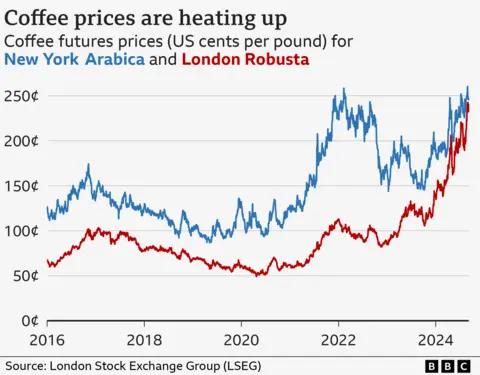

The price of unroasted beans traded on global markets is now at “historically high levels,” says analyst Judy Gans.

Experts blame a combination of complicated crops, market forces, depleted stocks — and the world’s smelliest fruit.

So how did we get here and how much does it affect your morning?

In 2021, a freak freeze wiped out coffee crops in Brazil, the world’s largest producer of Arabica beans — commonly used in barista-made coffee.

This shortage of beans has led buyers to turn to countries like Vietnam, a primary producer of robusta beans, which are commonly used in instant mixes.

But farmers there faced the region’s worst drought in nearly a decade.

According to Will Firth, a coffee consultant based in Ho Chi Minh City, climate change affects the growth of coffee plants, which affects bean yields.

Later, Vietnamese farmers developed a fragrant, yellow fruit – durian – durian.

Good pictures

Good picturesFruit – this Ban on public transport It is popular in Thailand, Japan, Singapore and Hong Kong – because of its fragrance – in China.

And Vietnamese farmers are cashing in on this growing market by replacing their coffee crops with durian.

Vietnam’s durian market share in China almost doubled between 2023 and 2024, and some estimate the crop to be five times more profitable than coffee.

“Farmers in Vietnam have a history of being fickle in response to market price fluctuations, overstocking and then flooding the market with quantities of their new crops,” says Mr Firth.

Exports of robusta coffee fell 50% in June compared to the previous June, and stocks are now “reduced”, due to a deluge of durians in China. According to the International Coffee Organization.

Exporters in Colombia, Ethiopia, Peru and Uganda have ramped up but are not producing enough to ease a tight market.

“Exactly [the] “The timing of things starting to pick up for demand for Robusta is right when the world is clamoring for more supply,” explains Ms Ganes.

That said, Robusta and Arabica beans are now trading at higher premiums in commodity markets.

A brewing market storm

Is the changing global coffee economy really affecting the price of your coffee on the high street? Short answer: possible.

Wholesaler Paul Armstrong believes coffee drinkers could soon face the “crazy” prospect of paying more than £5 in the UK for their caffeine fix.

“It’s a perfect storm at the minute.”

Mr Armstrong, who runs East Midlands-based Carrara Coffee Roasters, imports beans from South America and Asia, which are then roasted and sent to cafes in the UK.

He tells the BBC he recently raised his prices, which he believes is the reason for the higher prices – but says costs have “escalated” since then.

As some of his contracts expire in the coming months, he says the cafes he serves will have to decide soon whether to pass on higher costs to their customers.

Mr Firth says some segments of the industry will be more exposed than others.

“It’s really commercial coffee that’s going to experience the most disruption. Instant coffee, supermarket coffee, gas station stuff — it’s all on the rise.”

Industry figures caution that higher market prices for coffee do not necessarily translate into higher retail prices.

Felipe Barretto Croce, CEO of FAFCoffees in Brazil, admits that consumers are “feeling the pinch” as prices rise.

But he argues that “it’s mostly due to generally inflationary costs” such as rent and labor rather than the price of beans. Consultancy Allegra Strategies estimates that beans contribute less than 10% of the cost of a cup of coffee.

“If you make it at home, coffee is still very cheap, a luxury item.”

He also says that high-quality coffee may now be seen as better value as the price of low-quality beans rises.

“If you go to a specialty coffee shop in London and drink coffee, the difference is the coffee at Costa Coffee. [in price] The gap between that cup and specialty coffee is much smaller than it used to be.”

But there is hope of price relief.

Loses future land

Mr Croce says the upcoming spring crop is now “crucial” in Brazil, which produces a third of the world’s coffee.

“Everyone is watching to see when the rains will return,” he says.

“If they come back early, the plants should be healthy enough and the flowers should be good.”

But if it rains in late October, yield forecasts for next year’s crop will fall and the market crisis will continue.

In the long term, climate change poses serious challenges to the global coffee industry.

Good pictures

Good picturesA study Even with drastic reductions in greenhouse gas emissions from 2022, the area most suitable for growing coffee will shrink by 50% by 2050.

One measure to future-proof the industry that has Mr Groce’s support is the “green premium” – a small tax on coffee offered to farmers to invest in regenerative farming practices that help protect and sustain the viability of farmland.

The smelly fruit is partly to blame for the price hike now — and a changing climate could ultimately reduce coffee’s affordability in the years to come.